Summary

- US Treasury (UST) yields stabilised in April. Yields came off despite domestic data confirming that the US economy had gained momentum, and inflation numbers that were above market expectations. The Federal Open Market Committee statement announced no new changes to the direction of monetary policy but offered a more upbeat tone on the outlook. Overall, the benchmark 2-year and 10-year yields ended the month at 0.161% and 1.628%, respectively, about 0.1 basis points (bps) and 11.5 bps lower compared to end-March.

- The Asian credit market saw significant volatility in April, gaining 0.15% as lower UST yields more than offset the 3.7 bps widening in credit spreads. In April, Asian high-grade (HG) credits declined 0.19%, with spreads widening by 2.9 bps, while Asian high-yield (HY) returned 1.26%, with credit spreads narrowing by 2.6 bps.

- Within the region, headline inflation prints registered mostly higher in March. Gross domestic product (GDP) growth accelerated in 1Q 2021, while some central banks left their policy rates unchanged. Fitch Ratings affirmed India's "BBB-" rating with a "negative" outlook, and Standard & Poor's affirmed Indonesia's credit rating at "BBB", retaining the "negative" outlook.

- We continue to be selective in our duration exposures and are relatively cautious on low yield countries such as Singapore, South Korea and Hong Kong. We remain defensive on regional currencies, in anticipation of possible further USD strength on the back of US growth optimism.

- We expect Asian credit spreads to have scope to tighten modestly from here, driven by the ongoing economic recovery, supportive fiscal and monetary policies and progress on COVID-19 vaccination. While the macro backdrop remains favourable, specific downside tail risks have increased.

Asian rates and FX

Market review

UST yields stabilise in April

The US rates eased in April after a surge in the first quarter of 2021. Yields came off despite domestic data confirming that the US economy had gained momentum, and inflation numbers that were above market expectations. News that the distribution of some COVID-19 vaccines had halted caused some flight to safety mid-month. The move lower in yields subsequently lost steam, as investors opted to stay side-lined ahead of the US Federal Reserve's (Fed) policy meeting. The Federal Open Market Committee statement eventually announced no new changes to the direction of monetary policy but offered a more upbeat tone on the outlook. Fed Chairperson Jerome Powell noted that upward pressure on prices in the coming months is to be expected. As these are due to transitory factors, however, including base effects and temporary supply bottlenecks, a change in the Fed's monetary policy was not seen as necessary. At month-end, the US reported that the first quarter real GDP increased at a 6.4% annual rate. Overall, the benchmark 2-year and 10-year yields ended the month at 0.161% and 1.628%, respectively, about 0.1 bps and 11.5 bps lower compared to end-March.

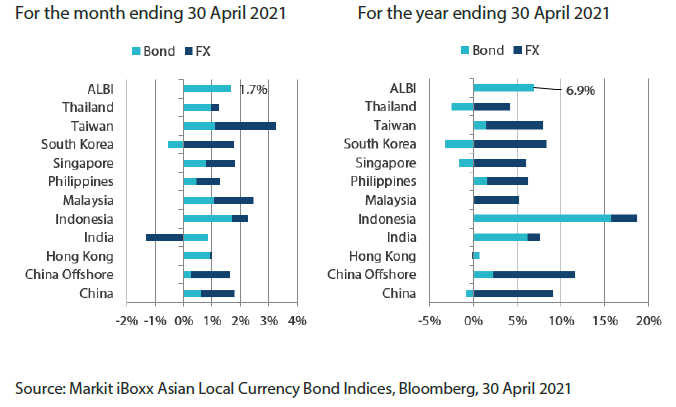

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Headline inflation prints register mostly higher in March; GDP growth accelerates in 1Q 2021

A rise in transport inflation was a key factor that prompted headline consumer price indexes (CPI) in South Korea, India, Singapore, Malaysia and Thailand to print higher in March. Indonesia's March headline CPI was largely unchanged, whereas inflationary pressures in the Philippines moderated slightly, settling at 4.5% year-on-year (YoY) as slower food inflation offset higher transport costs. Separately, GDP growth in China, Singapore and South Korea accelerated in the first quarter of 2021. China's economy expanded at a record 18.3% YoY in the first quarter, albeit off a low base due to the pandemic. In Singapore, preliminary data revealed that GDP growth over the same period picked up to 0.2% YoY (from -2.4% in 4Q20). Elsewhere, South Korea's economy picked up sharply, rising 1.8% over the period, due partly to a pick-up in private consumption.

Central banks leave their policy rates unchanged

Monetary authorities in South Korea, India, Singapore and Indonesia kept their respective policy rates unchanged. The Reserve Bank of India committed to remain accommodative until prospects for recovery are "well-secured" and committed to buy trillions of government bonds in fiscal year 2022, in a signal that it intends to manage bond yields. Bank Indonesia (BI) cited global financial market volatility and the need to maintain rupiah stability as reasons for keeping the policy rate unchanged. BI also announced another reduction in its forecast of 2021 GDP growth, despite revising its 2021 global economic growth projection higher, suggesting that the bank is expecting some disappointment from domestic demand. In South Korea, the central bank governor hinted at a more upbeat growth outlook, on the back of a faster-than-expected pick-up in private consumption. Similarly, the Monetary Authority of Singapore noted that prospects for global growth have firmed, and now expects 2021 GDP growth to likely top its official forecast range.

Fitch Ratings affirms India's rating; Standard & Poor's affirms Indonesia's credit rating

Fitch Ratings affirmed India's "BBB-" rating with a "negative" outlook. According to the rating agency, the negative outlook reflects "lingering uncertainty around the debt trajectory, following the sharp deterioration in India's public finance metrics because of the pandemic from a previous position of limited fiscal headroom". Meanwhile, Standard & Poor's reaffirmed Indonesia's credit rating at "BBB", retaining the "negative" outlook on expectation "that Indonesia will face sustained fiscal and external pressures related to the COVID-19 pandemic over the next 12-24 months."

Market outlook

Cautious on rates markets; taking a defensive stance on currencies

We have assumed a cautious view of the rates market and are taking a defensive stance on currencies. Despite stabilisation in US rates in April, flows into local government bond funds remained relatively weak. Going forward, we expect global growth recovery to gain momentum, and expect the risk for US rates to resume its uptrend as investors re-focus on the reflation theme. Meanwhile, as COVID-19 cases rise rapidly in countries such as India, Malaysia, Thailand and the Philippines, we will be vigilant to any adverse impact this current wave may have on the respective economies.

We continue to be selective in our duration exposures and are relatively cautious on low yield countries such as Singapore, South Korea and Hong Kong. We remain defensive on regional currencies, in anticipation of possible further USD strength on the back of US growth optimism.

Asian credits

Market review

Asian credits register marginal gains in April

The Asian credit market saw significant volatility in April, gaining 0.15% as lower US Treasury (UST) yields more than offset the 3.7 bps widening in credit spreads. Concerns towards a Chinese state-owned non-bank financial institution spilt over to the broader HG space, pushing Asian HG credits to underperform their HY counterparts. For the month of April, Asian HG credits declined 0.19%, with spreads widening by 2.9 basis points (bps), while Asian HY returned 1.26%, with credit spreads narrowing by 2.6 bps.

Concerns were first triggered by the particular Chinese state-owned non-bank financial institution’s announcement of a delayed release of its 2020 financial results. Sentiment towards other Chinese state-owned enterprises weakened as investors began to question assumptions about government support that underpinned the creditworthiness of state-owned borrowers. Reassuring comments from the China Banking and Insurance Regulatory Commission mid-month allayed some fears, and helped partially reverse the spread widening since the start of the month. Although bonds remained volatile for the remainder of April, market focus shifted to India in the latter half of the month, as the country saw its daily COVID-19 cases repeatedly spiking to new global records. During the month, Fitch Ratings affirmed India’s rating at “BBB-/Negative”, and Standard & Poor’s affirmed Indonesia’s rating at “BBB/Negative”.

By country, spreads of most major segments, save for Taiwan, Indonesia, Hong Kong, and Singapore, widened in April. Not surprisingly, Chinese credits significantly underperformed. Concerns that the ongoing second COVID-19 wave in India would trigger economic growth downgrades weighed on Indian credits. In contrast, strong 1Q21 gross domestic product (GDP) growth in Taiwan and Singapore partly supported the outperformance of the two markets, and resumption of inflows into the Emerging Market (EM) space benefitted Indonesian credits.

Primary market activity unperturbed

In April, 55 new issues raised a total of US dollar (USD) 29.9 billion in the market. The HG space saw 40 new issues amounting to USD 26.31 billion, including the USD 4.15 billion four-tranche issue from Tencent Holdings, USD 3.5 billion three-tranche issue from TSMC Global, and USD 3.0 billion dual-tranche issue from Petronas Capital. Meanwhile, the HY space had 15 new issues amounting to about USD 3.59 billion.

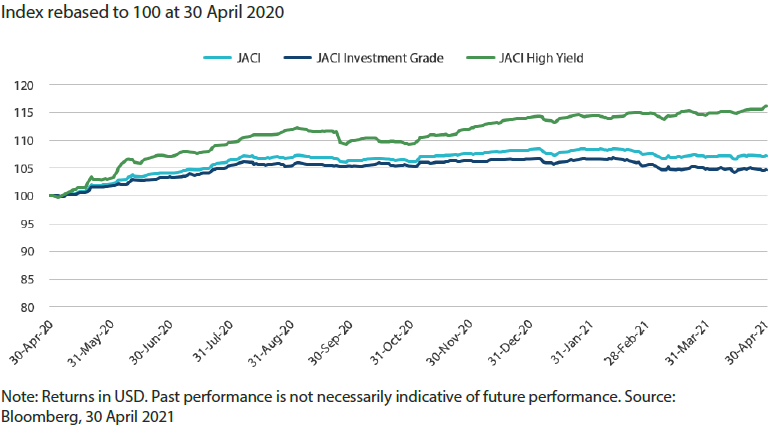

Chart 2: JP Morgan Asia Credit Index (JACI)

Market outlook

Asian credit spreads to remain resilient, though downside risks remain

We expect Asian credit spreads to have scope to tighten modestly from here, driven by the ongoing economic recovery, supportive fiscal and monetary policies and progress on COVID-19 vaccination. Overall corporate credit fundamentals should remain robust, with sequentially stronger earnings momentum in the first half of 2021 (1H 2021). That said, valuation is more neutral now having priced in a lot of the improving fundamentals. Further spread tightening from here will be more laboured, with more frequent market pull-backs likely. While the macro backdrop remains favourable, specific downside tail risks have increased.

The reflation theme that gained momentum in late February to mid-March appears to have taken a breather for now but may resume with global growth and inflation data expected to be very strong over the next few months. While the rise in yields is, to a large extent, justified by the improving economic outlook, a steep increase may revive pressure across many risk assets, including credit spreads.

In addition, the risk of US-China bilateral relations failing to stabilise remains elevated. Uncertainties relating to offshore bonds issued by a state-owned non-bank financial institution have led to some widening across China investment grade credits, including the quasi-sovereign space. While the contagion to other parts of Asia credit has so far been limited, the outcome of this event may influence China credit performance as well as broad market direction in the coming months. In India, a renewed surge in COVID-19 cases, and resultant containment measures, will likely dent growth recovery in 1Q FY22 (April to June quarter). If prolonged, concern around India’s sovereign rating downgrade may intensify again given the diminished buffer.