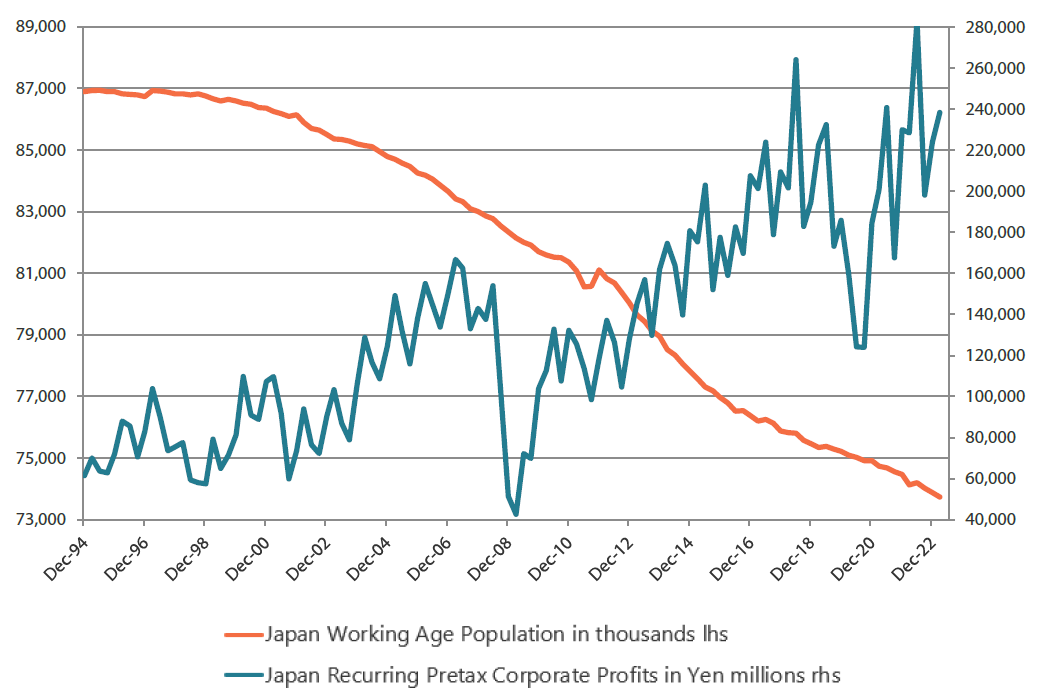

It isn’t wise to dwell on the details of any countries’ newly published macroeconomic data, as it is usually revised quite a bit, especially in Japan, but the overall outlook for the country is slow but steady economic growth. However, as the last few decades have shown, such should not discourage investors if the powerful corporate governance trends and technological advancements continue as we believe they will. Indeed, Japan’s corporate profits have surged over the past decade despite tepid domestic growth and declining demographics. As automation is developing rapidly, poor demographics will likely matter even less in the next decade. Indeed, hopefully this is true for nearly every other major Asian economy, as many of them, including China, have even worse demographic profiles.

Japan’s long-term profit trend

Clearly, Japan’s corporate profits are impacted by global economic growth, with China and the US playing reasonably significant roles, so if global growth suffers, Japan will too, but the long-term profit trend seems solidly upward. Besides the questions about China’s economy, perhaps the newest factor regards the Bank of Japan’s policies. In my view, its leadership was expecting a US recession in 2023, but in late 2022 it made the first shift towards less dovish policy by widening the Yield Curve Control (YCC) band because it realised a recession was not imminent. It continued to be very cautious about hawkish moves because in several of the last several global cycles, it raised rates just before global downturns and was lambasted by the media, politicians and most street economists for doing so. In July, the BOJ effectively widened the YCC band further, which surprised all but a few economists, primarily in the major Western investment banks. As of late August, the 10-year yield has not reached this cap, but we expect it to rise further in the coming quarters. Looking forward, unless there is a major downturn in the global economy, whether sparked by a Western credit crunch, a major recession in China, a geopolitical event or some other factor, it seems likely that the BOJ will add some additional hawkish elements to its policy. If it actually hikes short-term policy rates significantly, which is far from impossible in the first half of 2024, this will hit the government’s fiscal balances and hurt consumers as a large majority of mortgages are pegged to short-term rates.

Thus, not all is necessarily rosy ahead, but if the BOJ can tighten gradually, the effect should not overwhelm the economy. Japan has a great number of growth factors, especially in the corporate sector. It leads the world in many green technologies and has long been known for its energy efficiency and cleanliness. It clearly is the leader in hybrid automobiles, miniaturised non-memory electronic components and leading-edge materials, along with many other industries, and there is little reason to believe that it will stop innovating, and capitalising on such, at a rapid pace.

Chart 1: Secular bull market in profitability not impacted by demographics

Source: Bank of Japan, June 2023

To learn more about unlocking Japan’s hidden value, read Nikko AM’s investment guide here.

If you have any questions on this report, please contact:

Nikko AM team in Europe

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.