Snapshot

The Russian invasion of Ukraine and the subsequent war involving a global military superpower has created significant uncertainty for investors. The condemnation from the rest of the world has been united, backed up with punitive sanctions that most certainly will damage Russia’s economy, along with the potential to materially weigh on global demand while adding to inflationary pressures. Certainly, Europe is at the epicentre and likely to experience the greatest economic pain (outside of Ukraine and Russia). For the rest of the world, higher commodity prices are a given, but it is less clear how and to what extent higher prices and elevated uncertainty will weigh on final demand.

Prior to the war’s outbreak, central bankers were already facing a challenging inflationary environment, and these new commodity-driven price pressures are set to complicate matters even further. However, considering that policy makers must also weigh up the likely negative impact on global demand, markets are taking some consolation in the idea that monetary policy may not be tightened nearly as aggressively as thought just a few weeks ago. This could well be the case, but the geopolitical risks overall do not paint a positive backdrop for growth assets.

As tempting as it may be to speculate on the contours of what might lie ahead, it is still too early to draw conclusions; therefore, it may be more prudent to stay light on risk until there is better visibility. Meanwhile, there are still yield opportunities in some quarters, though we prefer to stay light on duration risk. Commodity-linked growth assets are interesting due to the protection they offer against inflation risks. Gold may also provide protection against high inflation and exceptionally high geopolitical risks.

Cross-asset1

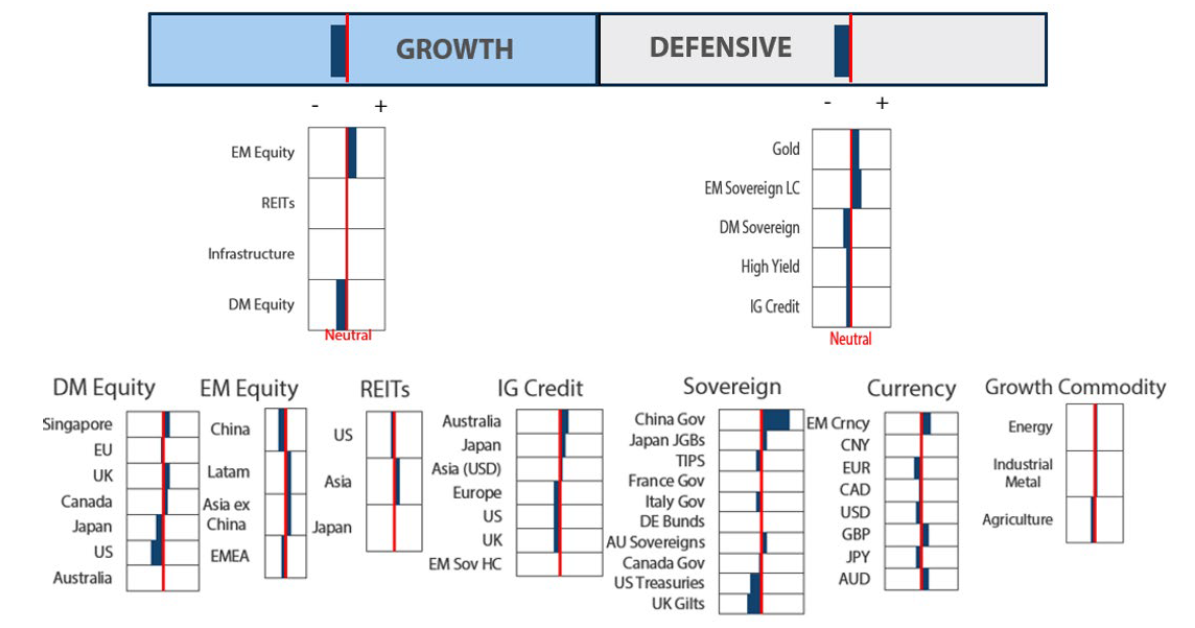

We downgraded our view on growth assets again this month to a small negative while remaining cautious on defensive assets. The Russia-Ukraine war was certainly an unwelcome surprise, to say the least, and while their collective economies are small relative to the rest of the world, the events introduced a host of uncertainties revolving around disruptions in exports of energy and other commodity supplies. In addition, the potential knock-on effects from excluding certain Russian banks from SWIFT and curtailing the central bank’s access to its reserves are difficult to predict. While Russia and Ukraine will clearly bear the brunt, the rest of the world, in particular Europe, will also be impacted by the crisis, with the rise in commodity prices exacerbating existing inflation pressures while potentially biting into demand.

The question now is the extent to which these new headwinds will add pressure to a nascent recovery in global demand as the worst of the pandemic passes. Clearly, the job of central bankers will become even more difficult as inflationary pressures build further amidst new risks to demand growth. Thus, we reduce our view on growth assets to below neutral—becoming more cautious on developed markets (DM) while favouring emerging markets (EM), where we see the potential for a continued rotation. On the defensive side, we reduced DM sovereigns mainly on the recent upward pressures on China bond yields driven by an accelerating credit impulse. We are positive on EM local currency bonds where we still see opportunities for high yields with an advanced state of tightening in many EM countries. We also raised our commodity score to overweight, which benefits from tightening commodity supplies and its effectiveness as a hedge against other risks in the portfolios.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

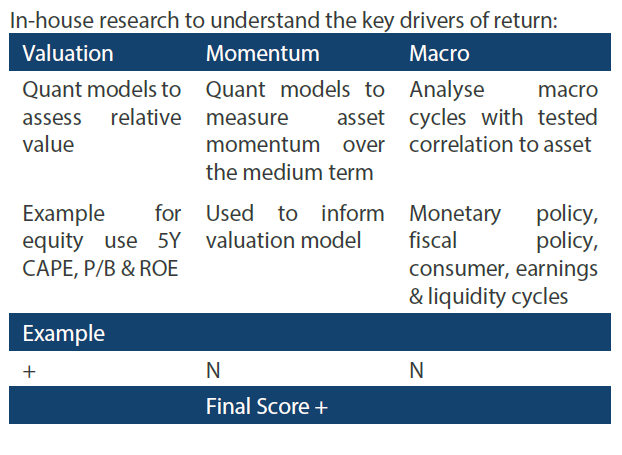

Asset Class Hierarchy (Team View1)

1asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

As the growth outlook becomes more opaque, we believe that positioning becomes extremely important. Taking a cautious view on equities would be sensible, in our view; doing so can even add protection on a more prolonged basis as risk may remain skewed to the downside until there is better clarity on the war and the knock-on effects of the sanctions that are yet to fully thread through the system.

As we consider the proper positioning, we believe that a part of the answer lies in understanding current stress points that could be exacerbated by the war and the sanctions. Notably, even before the war inflation was already a persistent stress point, driven in part by supply chain disruptions. But inflation has also been stoked by limited supply capacity among commodity producers, with investment having remained weak for many years. At this point, given the war and the sanctions that followed, supply disruptions may only grow more acute, likely adding to inflationary pressures around the world.

Of course, there are other factors to consider as well. Central banks across the developed world were already preparing to tighten policy to head off inflation that was stickier than they had hoped for, but now the war is compounding their problems. While the central banks cannot really control supply-side price pressures, they may need to hike rates to impede demand, and bringing down price pressures in such a way could be ultimately more negative for the growth outlook.

We still like growth assets, albeit from a much-altered viewpoint. As far as growth versus value goes, we still see further adjustments across secular growth categories as reduced stimulus dents earnings growth and as multiples settle towards levels that make better sense in a higher rate environment. However, cyclicals could also be vulnerable if the combination of rising prices and rates ultimately hinders broad demand.

At present, we prefer a mix tilted to find the upside in commodity-linked equity exposures. With this segment of the equity market having already moved a great deal, we will take a deeper look at these types of exposures this month.

Commodity-linked equities: When conflict creates value

Commodity-linked equities have essentially fallen out of favour for more than a decade—starting with China pulling back from massive over-investment in infrastructure, to the 2015 general collapse of the energy sector as OPEC broke down and US producers found that they had significantly over-invested in shale oil production. Investment in production capacity essentially halted across the commodity complex, and the recent policy push toward net zero emissions only further dissuaded any new investment in production capacity.

For a lack of new investment, commodity prices were already on the rise —those of energy, in particular. Part of the rise is due to policy, with higher prices for fossil fuels driving investment into greener replacement technologies. We expect the Russia-Ukraine war and the resulting sanctions on Moscow to further diminish global production capacity across energy and metals, adding to already tight supply pressures. As rising commodity prices tend to support earnings growth among commodity producers, we will evaluate the asset class for further exposure.

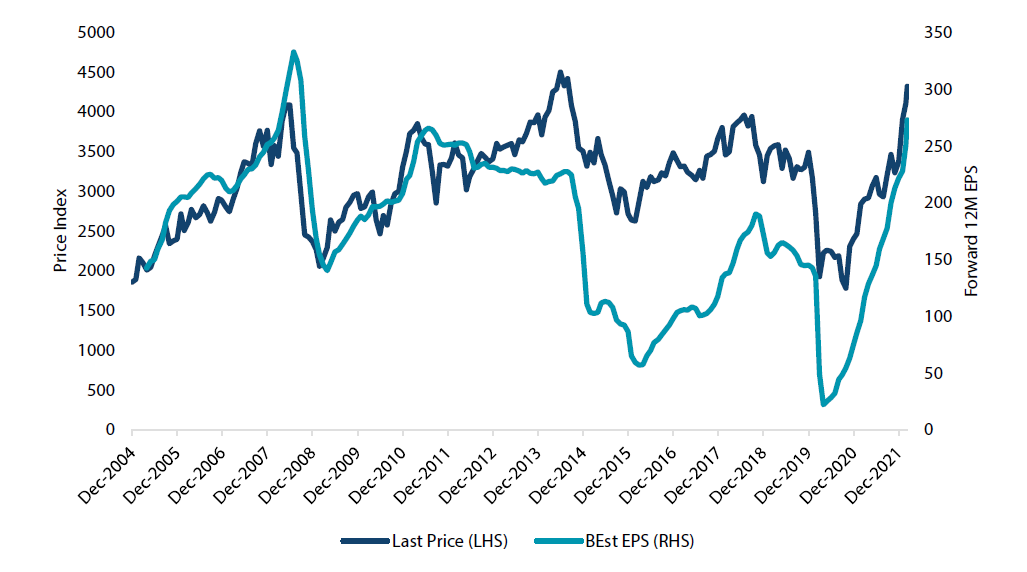

First, given the rally to date, it is fair to ask whether the surge might be overdone. The global energy sector is up a whopping 140% from the October 2020 low. But importantly, earnings estimates are up just over 400%, leaving the forward PE ratio at 8.5, which is still a considerable discount relative to the 15.6 priced for global equities (ACWI).

Chart 1: Global energy earnings versus price

Source: Bloomberg, March 2022

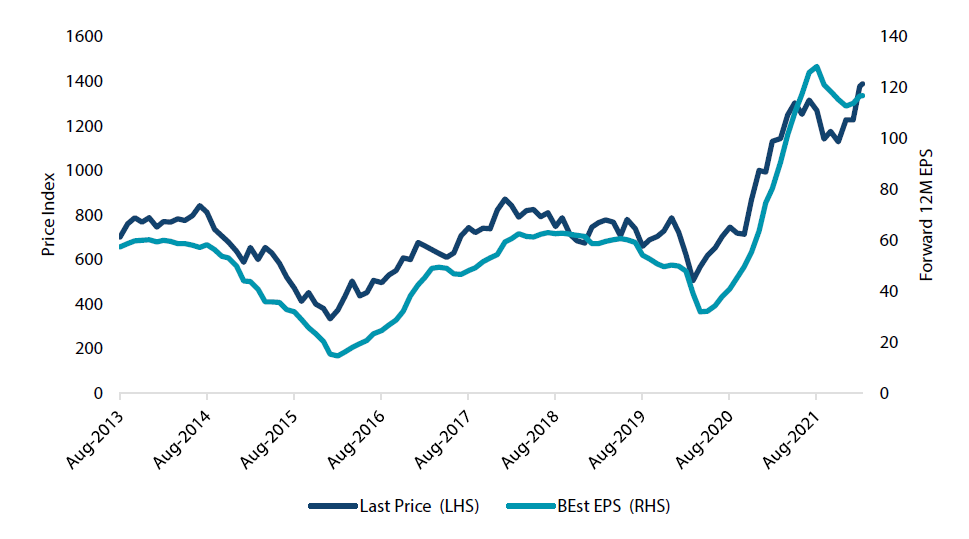

It is a similar story for metals and mining stocks, which are up over 120% from the February 2020 low while forward earnings have risen 144%, giving the sector a forward PE ratio of just 8.1. Are earnings at risk of decline? Not likely, in our view, given that earnings projections have yet to fully reflect price rises to date. Yes, the war will eventually end and perhaps the sanctions will also be lifted, which would naturally bring commodity prices back down to earth. But current earnings forecasts mainly reflect supply-demand dynamics that preceded the war and resulting sanctions and these factors do not change despite the conflict in Europe.

Chart 2: Global mining earnings versus price

Source: Bloomberg, March 2022

Commodity-linked equities appear favourable from a multi-asset perspective, due to their earnings growth prospects and reasonable valuations. In addition, commodity-linked equities also serve as a hedge for inflationary pressures that tend to weigh on bond yields, earnings and valuations across other sectors that typically benefit less from inflationary conditions.

Conviction views on growth assets

- Becoming cautious on cyclicals: Although we favoured cyclical equities as demand returns to normal amid dissipating COVID-19 headwinds, we are now watching how higher energy prices can potentially impede global demand.

- Also becoming cautious on financials: We also previously favoured financials for their improving earnings prospects on rising rates. But we now see now see potential headwinds, mainly in the form of stress connected to the Russia sanctions, which could weigh on the sector.

- Still Favour commodities: As we view cyclicals and financials with more caution, we have increased our favourable view of commodities because their important defensive characteristics help offset equity and duration risks elsewhere in the portfolio.

Defensive assets

We further downgraded our already negative view on sovereign bonds this month. Global sovereign bonds found some safe-haven support at the onset of the Russia-Ukraine war and as the markets tried to anticipate the impact of sanctions on Russia. While these developments are likely to affect global growth negatively, persistently high energy prices and new disruptions to supply chains could leave a longer-lasting legacy. This unwelcome "new" inflation threat may keep central banks on a tightening path and continue pushing bond yields higher.

In global credit, we maintained our negative view as both investment grade and high yield credit spreads continued to widen. Among credit investors, guarded optimism from the reopening of the global economy in the wake of the pandemic has been replaced by geopolitical concerns. The impact of global sanctions on Russia is difficult to predict and could lead to unintended consequences. Credit quality remains strong, but we remain cautious until there is more visibility around the conflict in the Ukraine.

We continue to favour gold within our defensive asset universe for two main reasons. The first is rising inflation risk as soaring commodities prices are likely to delay any retreat in consumer prices and present a challenge for central bank policy. The second reason is elevated geopolitical risk sparked by Russia’s invasion of Ukraine and the escalation in tensions between Russian President Vladimir Putin and Western leaders. The myriad of financial sanctions imposed on Russia, including actions to block its participation in various aspects of the global financial system, have crushed its currency and may lead to other central banks reconsidering the composition of their reserves. In this light, gold may well be a beneficiary of future changes to reserve holdings.

Credit spreads and monetary policy

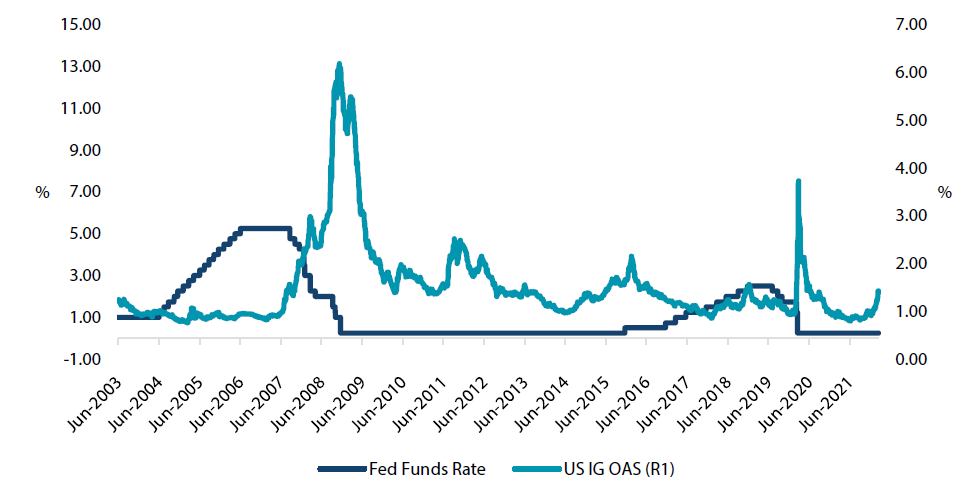

As we await the start of a global tightening of monetary policy, it is timely to consider the potential impact on investment grade credit spreads. With history as our guide, we look back at credit spread behaviour during the last two US tightening cycles in 2004–2006 and 2016–2018 in Chart 3. The first cycle featured a steady series of rate hikes that lifted the Fed funds rate from 1% to 5.25% over two years—an aggressive course of action that surprisingly had little effect on credit spreads that remained low and relatively stable during this period. However, we also know that this proved to be the calm before the storm of the Great Financial Crisis (GFC) that saw credit spreads blow up to distressed levels.

The next tightening cycle that began with a false start in 2015, only to restart a year later in 2016, was comparatively mild, with rates only rising from 0.5% to 2.5%. Credit spreads were also reasonably well-behaved during this period, contracting during the first half before widening in the second half and eventually narrowing again at the end of the cycle. In both these tightening cycles, credit spreads did not appear to come under widening pressure as central banks prepared to begin the process of tightening monetary policy. Hence, if impending tightening cycles are not a reliable harbinger of wider credit spreads, we need to look further afield and consider the link between spreads and the performance of risk assets.

Chart 3: US OAS versus Fed funds rate

Source: Bloomberg, March 2022

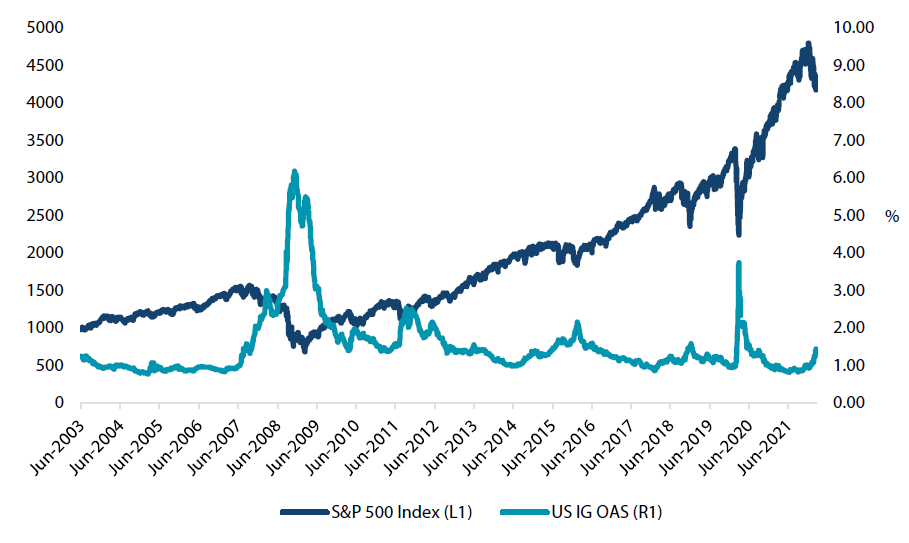

Chart 4 shows the relationship between credit spreads and the S&P 500 index over the same period. We can see multiple periods of weak performance by equities were accompanied by widening credit spreads, most notably in 2008 and 2020. While the cause and effect between falling equity markets and rising credit spreads can be difficult to ascertain, it seems clear that they are closely correlated during periods of market stress. This is perhaps not surprising as the profitability of companies is closely associated with credit worthiness and stock performance. When companies come under stress, weaker profitability can lead to both a degradation in credit quality and share price weakness.

Chart 4: US OAS versus S&P 500 index

Source: Bloomberg, March 2022

As we consider the current climate, credit spreads have been under widening pressure to start 2022 as we face both weaker equities and an impending tightening cycle from the Federal Reserve. We believe that of the two influences, it will be more important to monitor the behaviour of equities markets as an indicator of credit spread performance although overall liquidity conditions, as managed by central banks, are important to monitor for all asset classes.

Conviction views on defensive assets

- China bonds still favoured: China’s government bonds offer higher yields and continue to display low correlation to global rate moves. The renminbi has also been strong, attracting safe haven demand under the steady hand of the People’s Bank of China.

- Cautious on European credit: The conflict in Ukraine has resulted in potent sanctions on financial dealings and commodities trade that we expect to have the most direct impact on Europe’s economy and companies.

- Gold is a preferred safe haven: The combination of strong inflationary pressures and rising geopolitical risks should continue to support gold in a rising rate environment.

Process