Naomi Fink recently joined Nikko Asset Management as a Global Strategist based in Tokyo. We sat down with Naomi to discuss her personal relationship with Japan, and to hear her views on arguably the most talked-about investment region in the world at present.

Tell us about your role as Global Strategist with Nikko AM, and your return to Tokyo.

I chair the Global Investment Committee, and my role also involves developing investment insights and strategic guidance for Nikko AM’s clients across Japanese Equities, Asian Equities, Global Equities, and Global Fixed Income. It’s a particularly exciting time to be back in Tokyo because Japan is in much better shape than we've seen for years, even decades.

I used to say Japan was an incredibly frustrating but fascinating economy. It contains so many conundrums and puzzles, and the deeper you dig, the more interesting things are. But I think within the context of the last 30 years, Japan is on a much better footing than it has been for that whole time. There's real behavioural change afoot among Japanese corporates and consumers. But it's not like suddenly flicking a switch. It’s more gradual, but things are definitely pointing in the right direction for Japan.

What strikes you as being different now to the Japan you remember back then?

Japan has achieved an economic miracle by deflating its way to growth over the better part of the last thirty years. When I last left Japan, Japanese equities hadn’t yet turned around. This was before the three arrows of “Abenomics” were introduced in 20131. But it probably took a global supply shock and subsequent global inflation to provide the reflationary spark that’s giving fuel to the equity rebound this time.

On the surface, deflation is just a decline in prices, but it brings with it profound changes in normal consumer behaviour. And because this deflationary period lasted so long, consumers have developed a very cautious approach to consumption, and unlearning that will take some time. Going from mild deflation to mild inflation may sound underwhelming, but it is a big deal, because it’s being accompanied by a rational—even if gradual—change in mindset.

What about the corporate climate in Japan, how has that changed in recent times?

Companies are doing things we haven’t seen from them before—such as appointing external directors, listening to corporate governance demands or shareholder requests for better disclosure, sometimes even in English. They have also been disclosing medium-term plans for investment. That’s very important because companies have been holding onto cash balances totalling over Japanese yen 300 trillion. It’s only natural shareholders want to know how that excess cash will be put to work.

Previously, the rational approach was to keep hold of cash. But today, companies are looking to invest in technology that will help keep costs lower while staying productive and still retaining quality staff. So companies are now investing in innovation that is far more likely to transform their productivity. As a result, we’re in the early stages of a huge investment cycle as Japanese companies adapt to skilled labour shortages while staying profitable.

Do you think consumers are starting to change their mindset too?

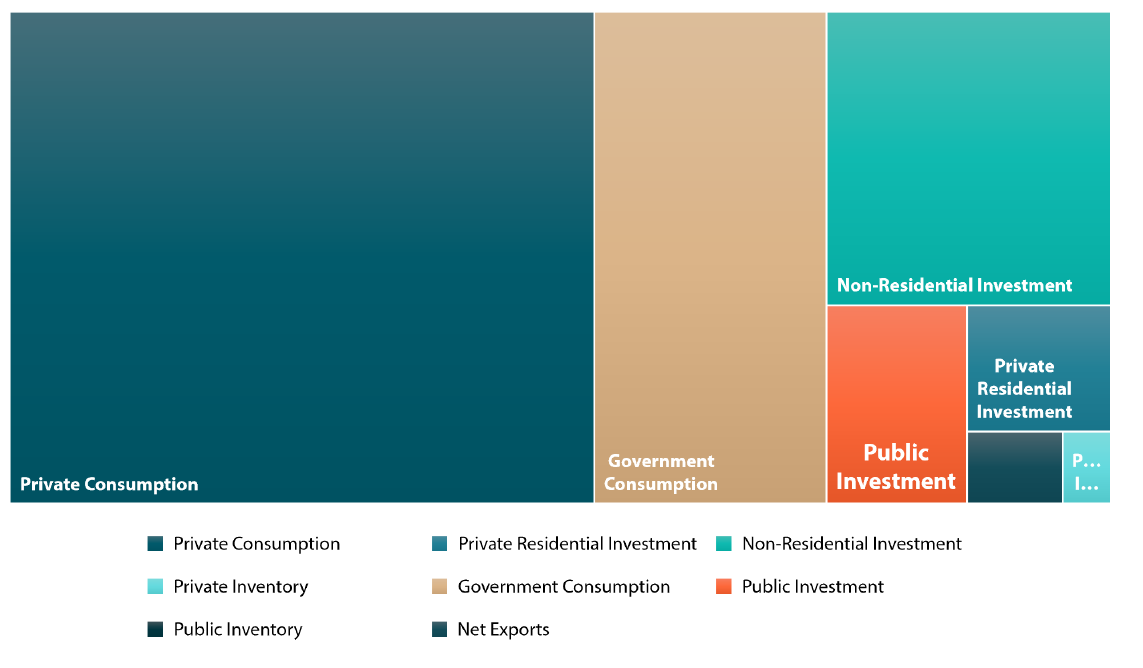

Yes, I think there’s a gradual shift underway, with households on the verge of realising that rising equity markets are good for them, too. We’re still only at the early stages of seeing consumer attitudes shift from savings to investments, but after the historic wage rises from the “shunto” in March, there’s good reason to expect real wage rises before the year is out. That real wage rise is a catalyst to change the behaviour of Japan’s households, because consumption is such a large part of Japanese GDP. Right now, in economic terms, Japan’s domestic consumption growth is still anaemic, and exports are doing most of the work. Even a small marginal change in domestic consumption and investments could have a huge impact on GDP overall.

Chart 1: Breakdown, Overall GDP of Japan

Source: Bloomberg

Given the meteoric rise in valuations, are there any areas of real opportunity still available, or does everything look overbought now?

One thing that can keep Japan as a relative outperformer is the secular side of the upturn. If somebody asks me if the weak yen is helping listed companies with overseas earnings—yes, without a doubt. But that’s not the whole story. Whereas the US equity rally has largely been driven by the Magnificent Seven2, Japan’s rally has been far broader than just the tech sector. It's not all cyclical, so there are good reasons to buy and hold.

At the same time, valuations don’t appear stretched. Although the main indices returning to their historical highs made global headlines, over the last 20 years, Japan hasn’t touched any big valuation barriers, whereas for the US and globally, the recent outperformance of tech growth stocks means we are in unchartered territory. I’m not saying there’s no merit to the tech-driven AI-led boom, but there’s rarely a straight line leading from an initial investment into technology to a transformation of the underlying economy. I think progress will be bumpier than currently being priced in by markets. There might well be some pull-backs, and I think Japan would be a good place to be during pull-backs because Japanese companies are not as richly valued as yet.

Also, many companies in Japan have not yet made the investment in productivity-enhancing technology and, therefore, haven’t attracted much investment. The TOPIX price-to-book ratio is now above the magical level of one, on average, but roughly half the firms listed on the TOPIX are below one. For good stock pickers, this means there is still value to be found among some of those “late bloomer” firms.

What did you make of Prime Minister Fumio Kishida’s recent plans to transition Japan to “a new economy with a virtuous cycle of growth and distribution”. Can a “new form of capitalism” be cultivated in Japan?

Stakeholder capitalism has always been the basis of Japan’s capital market. But in the past, shareholders were a lower priority than other stakeholders. That is changing now. I don’t think Japan is going to implement the US model of shareholder primacy, but there’s no justification for publicly listed companies to behave as though they were privately owned. I don’t expect Japan to copy the US, but there are some elements to be borrowed and advantages to be gained.

For example, just as America’s 401k system gave US citizens a stake in the US stock market, recent domestically-focused investor initiatives like the Nippon Individual Savings Account (NISA) are capable of driving greater household participation in financial markets in a sustainable way. In this context, there are probably clear gains to programs designed to increase financial literacy, particularly among younger generations who have never experienced inflation.

I also think that some of the aspects of stakeholder capitalism, such as environmental and social impact, are still very highly valued by global investors. Perhaps Japan has a comparative advantage when it comes to ESG, which has become politicised and unpopular in parts of the US right now. Here in Japan, it’s not a political consideration at all. So the lack of politicisation might help Japan gain greater leadership in this area of sustainable investment.

Japan’s relationship as a big exporter to the US and to China is often discussed as like walking a tightrope. Do you think Japan can continue to maintain its “friendshoring” approach and be successful in maintaining positive relationships with everyone?

I think one of the most astonishing things about the current economic balance is that if you told investors five years ago that the Chinese economy would slow considerably, yet Asia would be fine, I don’t think they would have believed you. But today, it’s a reality. India is booming and there are lots of excellent diversification opportunities within Asia. And Japan being part of—and cultivating relationships with various Asian economies—is a wonderful thing. It makes sense regionally, and there’s a good investment case too.

Can you finish by telling us about your personal relationship with Japan?

Before moving back to Japan for my role with Nikko AM, I lived here for some 12 years. My mother is Japanese, and growing up bilingual really gave me a love of languages and other cultures. Growing up bilingual and bicultural, felt to me like a gift, and I feel really fortunate to be able to give this same gift to my eight-year-old son, and enjoy all of the advantages that Japan has to offer.

I heard recently that more tourists are now visiting Japan from Thailand than the other way round, because people genuinely appreciate the experience of coming here. I'm really pleased, not only from a professional but also a personal perspective, that Japan is gaining more recognition after being underappreciated by the rest of the world for so long. The Japan of today is really making its mark, and that makes me very happy.

If you have any questions on this report, please contact:

Nikko AM team in Europe

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

1The ‘three arrows’ of Abenomics were: (1) aggressive monetary policy, (2) fiscal consolidation, and (3) growth strategy.

2Apple, Microsoft, Nvidia, Tesla, Meta, Alphabet and Amazon.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way